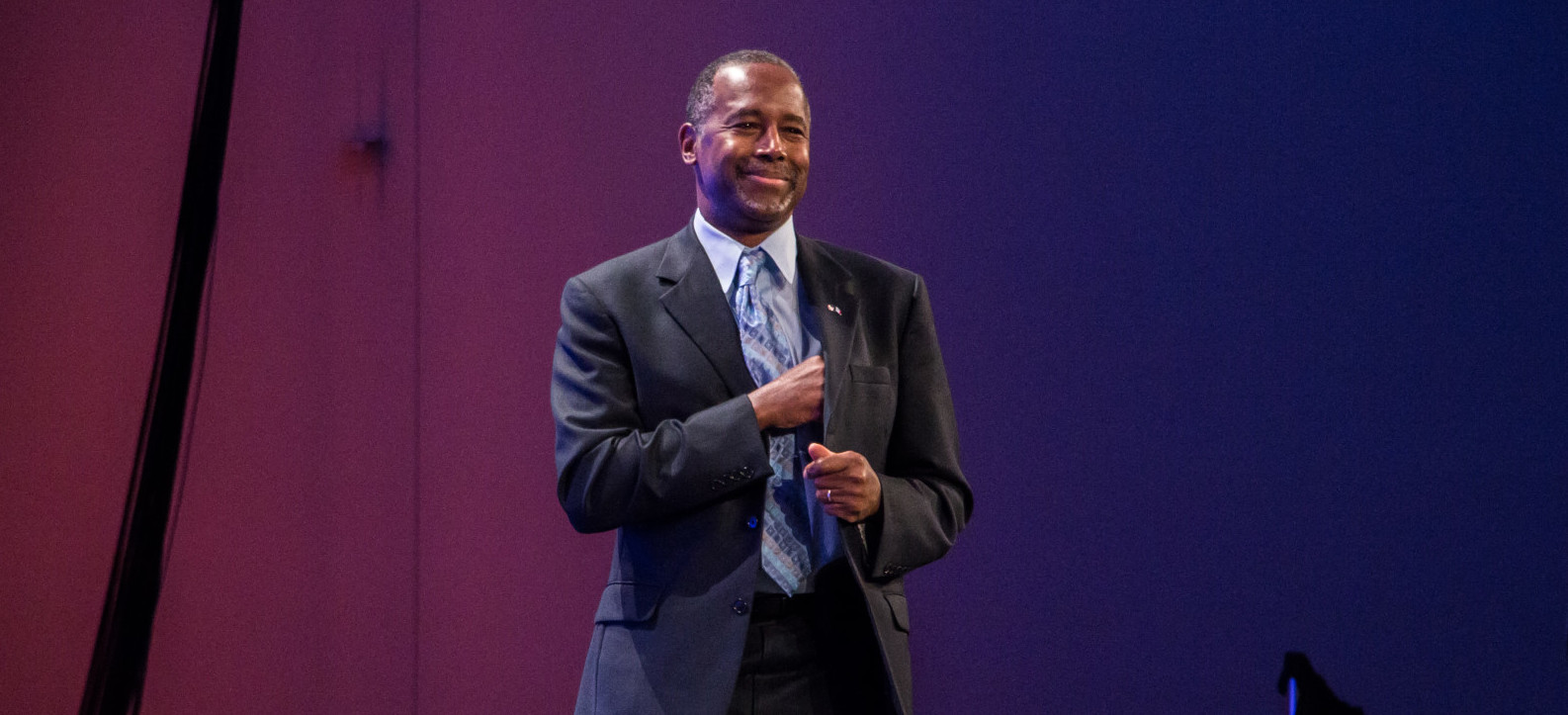

Ben Carson calls them “health empowerment accounts.” He wants to give them to everyone with a Social Security number at birth. They are the centerpiece of what may be the most radical health care plan presented by a Republican presidential candidate — insurance and health services bought by the individual.

There’s just one problem: New polling from Morning Consult shows that the public isn’t even close to ready for such a dramatic shift. They don’t know what these health accounts are, and they tend to think health insurance should come from employers.

Carson’s plan is built off of what are now known as “health savings accounts,” or HSAs. They are individual tax-free accounts that people can use to pay for out-of-pocket health expenses like deductibles or copayments.

Yet given a range of options, more than three-fourths of voters can’t accurately describe a health savings account, even when given a range of options. And 29 percent say they flat-out don’t know.

That makes sense because only 18 percent of voters say they have one. (Even that represents an increase from a few years ago. A separate survey commissioned by insuranceQuotes.com in February 2014 found that only 8 percent of Americans had a health savings account.)

Only 23 percent of respondents in Morning Consult’s poll correctly identified an HSA as a tax-free account for out-of-pocket health expenses that is linked to a high-deductible insurance plan.

About the same percentage (24 percent) incorrectly said that an HSA is a tax-free bank account for health expenses in which a person’s contributions are forfeited after one year. It’s not a surprise that people would mistake this type of an account for an HSA: That’s the definition for a flexible spending account, a common benefit that employers offer for employees to save tax-free for health or child care expenses.

Fifteen percent of respondents think an HSA is an account set up by an employer for an employee to cover out-of-network insurance costs or copayments, and 9 percent think an HSA is an account from which an employer or employee pays health insurance premiums.

[visualizer id=”20226″]

Perhaps understandably, confusion reigns. Health insurance is a complicated animal, and even with the Affordable Care Act, the public doesn’t appear to be well-versed in the alternatives to basic employer-provided coverage. Two-thirds of Morning Consult respondents said that Americans should receive their health coverage from their employers rather than on their own through exchanges or marketplaces.

High-deductible insurance plans are a big component of making an HSA system work. They are cheaper for both the insurer and the insured person because the individual must pay for a big chunk of their health services up front before the insurance coverage kicks in.

The health savings account is intended to offset the up-front expense by allowing people to save some cash, tax-free, for that very purpose. The entire system is more market-based than the employer-based health care, something most Republicans want.

Yet high-deductible insurance plans haven’t quite caught on with the public. Only 21 percent of voters have such a plan, according to Morning Consult’s polling.

When asked their opinion about high-deductible plans, survey respondents are more likely to agree with negative statements that positive ones. Almost seven out of 10 voters (69 percent) agree with the statement that high-deductible insurance plans are “generally are only good for people who don’t go to the doctor often and want cheap insurance.”

About six out of 10 (57 percent) agree with the harsher statement that high-deductible plans are “a losing gamble against getting sick.”

Just over half of voters (52 percent) concur with the selling point for high-deductible plans — that “they are great way to keep monthly health premiums low and offer more care options.”

The idea for health savings accounts germinated in the early 1990s as way to control health costs, which were rising at an alarming rate. Then and now, most people get their insurance through their employers, although the Affordable Care Act has shifted that dynamic. Because the cost of health insurance is largely fixed, people tend to use health services without thinking about the cost.

The theory behind HSAs is that consumers will be better shoppers of health services if they are paying out of their own accounts for it. The tax-free accounts allow them to shield that portion of their income from the Internal Revenue Service. Both employers and individuals can donate to HSAs.

Importantly, HSAs also are supposed to help separate the link between employment and health coverage. If health insurance is so expensive that the only way to reasonably afford it is to have an employer provide it, people will be less likely to go into business for themselves or join startups that are too small to offer health benefits. Combined with cheaper, high-deductible insurance plans, HSAs can make insuring oneself affordable.

Carson may be on to something. His plan reflects what some health analysts have been saying for 20 years — that too many people are “overinsured,” which drives up health costs, and that the health insurance industry needs to be subjected to more individual market forces.

He isn’t alone among his GOP presidential contenders in touting HSAs, although he certainly takes the idea the farthest. Sen. Rand Paul (R-Ky.) and Rick Santorum both say they want all Americans to have access to HSAs, not just those with high-deductible plans. Jeb Bush says he wants contribution limits on HSAs to be higher.

(On the opposite end of the spectrum is Sen. Bernie Sanders, who might edge Carson out on the sheer radicalness of his health proposal. Sanders goes in the opposite direction: He wants to guarantee health coverage for all, paid for by the government.)

If any of these candidates finds himself in the Oval Office, however, he will have to sell the public on them. Otherwise, they will languish as an unused part of the tax code.