August 30, 2016 at 3:25 pm ET

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- E-mail to a friend

Official Washington erupted in bipartisan indignation over a European Commission ruling Tuesday that forces Ireland to recoup $14.5 billion in back taxes from Apple Inc. Lawmakers from both parties and officials at the White House characterized the mandate as an unfair and unilateral targeting of an American company.

On Tuesday morning, the European Union’s top antitrust regulator accused Ireland and Apple of reaching an agreement allowing the tech firm to pay a less than 1 percent tax on its European profits between 2003 and 2014. Determining that such an agreement was in violation of EU law, the commission ordered Ireland to recover what it said was $14.5 billion in unpaid taxes.

Several senators had already expressed concern over EU investigations into the tax practices of U.S. firms. A bipartisan group wrote a letter in May calling on Treasury Secretary Jack Lew to aggressively engage with the European Commission to ensure U.S. companies were not unfairly targeted.

It’s no surprise, then, that Senate reaction to the EU’s Apple ruling was swift.

“Any ruling that is inconsistent with international tax standards and harms American business abroad with retroactive measures is inherently unfair and encroaches on U.S. tax jurisdiction,” said Sen. Orrin Hatch (R-Utah), chairman of the Senate Finance Committee, in a statement provided to Morning Consult.

Hatch said it “appears the European Commission has issued an extraordinary decision that targets U.S. business,” although he noted that further investigation is warranted.

Sen. Ron Wyden of Oregon, ranking Democrat on the Senate Finance Committee, said the EU “effectively stepped outside the terms of existing bilateral tax treaties to hand an American firm a massive, retroactive tax bill.” Wyden said the ruling would make it more difficult to partner with other countries to prevent tax evasion, and he worried that American taxpayers would be “on the hook for a big portion of this penalty.”

“This is a cheap money grab by the European Commission, targeting U.S. businesses and the U.S. tax base,” Sen. Chuck Schumer, the chamber’s No. 3 Democrat and an active member in the Senate Finance Committee, said in a statement. The senior New York senator accused the EU of “unfairly undermining our ability to compete economically in Europe while grabbing tax revenues that should go toward investment here in the United States.”

Schumer, who has worked extensively on international tax issues, also called for an overhaul to the international tax system “to ensure these revenues come home.”

Resolving the inconsistencies between the U.S. and other countries’ corporate tax codes is a top priority for tax writers in both parties, although there are still disagreements about how to do it and what other tax-related proposals would be included in such a package.

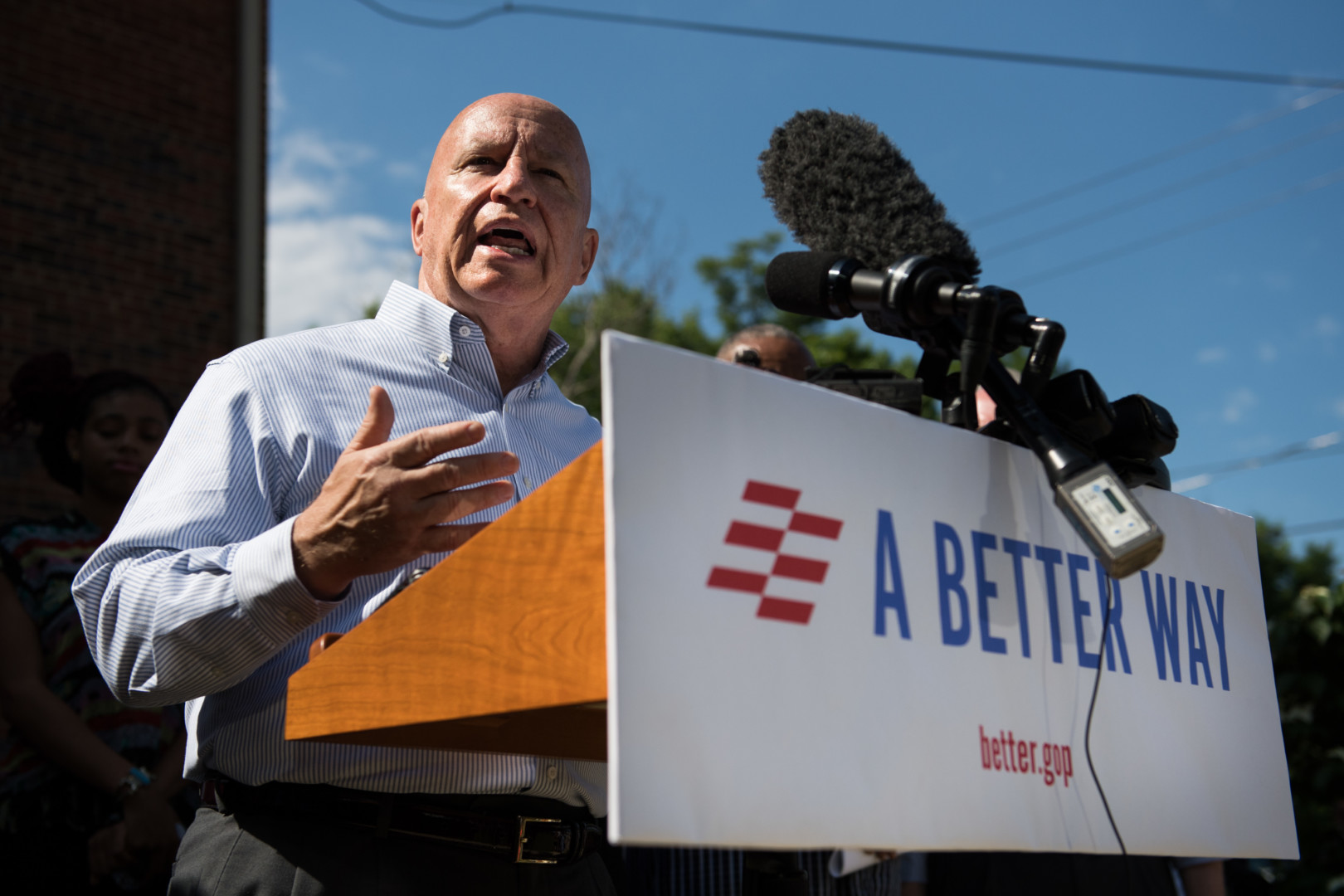

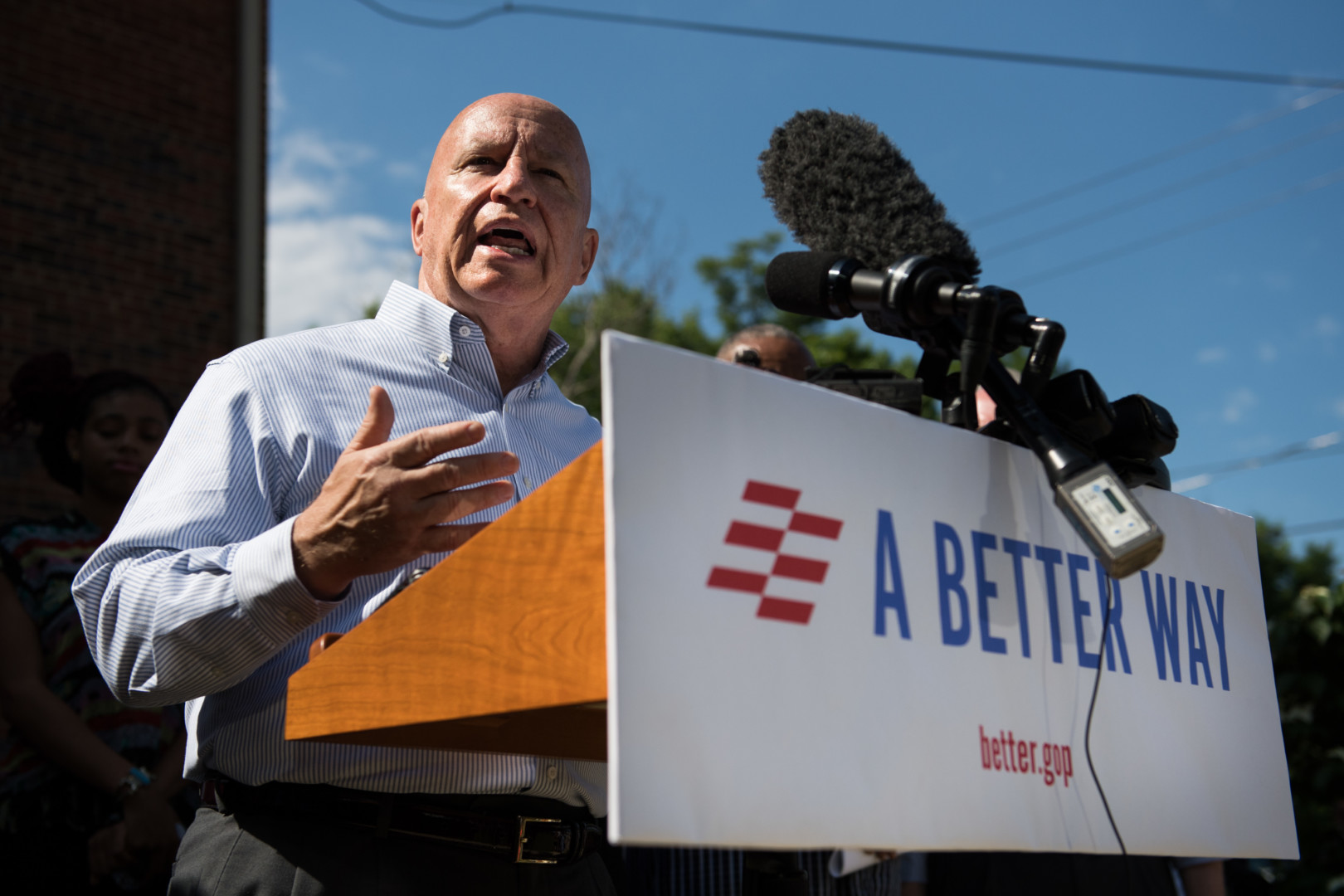

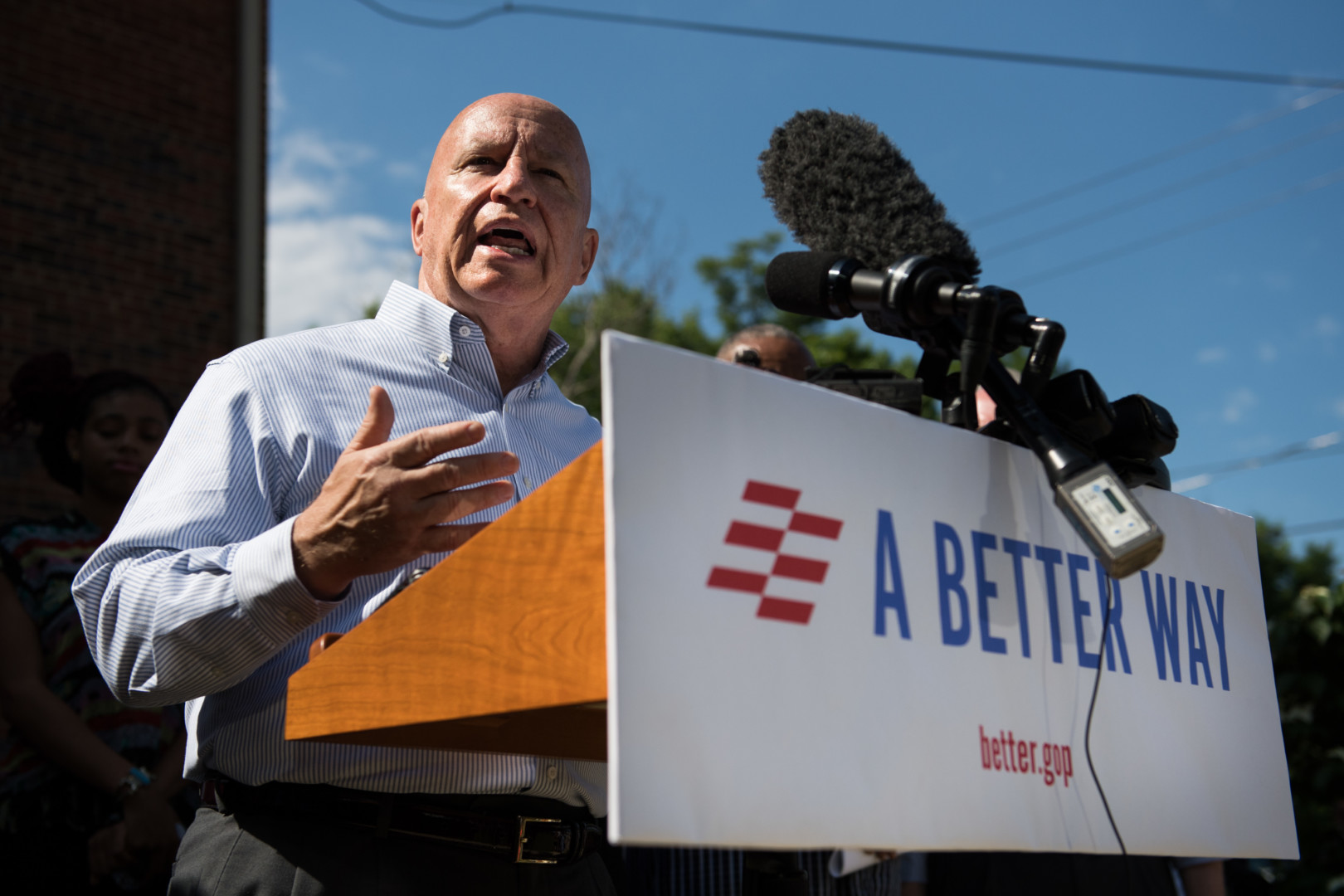

They appear to be in agreement about the EU’s actions, however. Rep. Kevin Brady (R-Texas), chairman of the House Ways and Means Committee, called the decision “a predatory and naked tax grab.” Alluding to the disparity in corporate tax rates between the U.S. and other developed countries, he said, “it is another extreme consequence of our broken tax code that continues to hurt American workers.”

Brady pushed his committee’s tax plan, part of House Speaker Paul Ryan’s “Better Way,” as one solution. The current tax code “strands American profits overseas” and “allow[s] other countries to deliver multibillion-dollar tax bills to American companies,” Brady said.

The speaker himself also weighed in on the ruling. “This decision is awful,” Ryan said in a statement posted to the speaker’s website. The Wisconsin Republican accused the EU of “slamming” Apple with a jobs-killing tax bill “years after the fact,” and said the ruling was in violation of treaties signed by many European countries. Like Brady, Ryan also plugged his “Better Way” tax plan as a possible solution to future disputes with EU regulators.

Rep. Sandy Levin (D-Mich.) was a lonely voice of dissent in a sea of congressional outrage over the EU’s decision. In a statement provided to Morning Consult, the ranking member on the House Ways and Means Committee said U.S. critics “must totally avoid legitimizing the practices of multinationals and some nations rigging the tax system so the companies pay little or no taxes for their operations.” While Levin said the argument that the EU is retroactively applying tax law should be investigated and appropriately litigated, “none of this is an excuse for the use of tax shelters or secret deals that ultimately allow multinational corporations to avoid paying their fair share.”

Like congressional Republicans, the Obama administration was also quite critical of the EU’s move. While White House Press Secretary Josh Earnest on Tuesday refused to specifically condemn the ruling, he said the tax payments implied in the EU decision “are merely the transfer of revenue from U.S. taxpayers to the EU.”

Any retroactive tax payments Apple makes to Ireland could be treated in the U.S. tax system as a current payment, Earnest said, essentially allowing Apple to deduct the EU payment from its U.S. tax obligations. “I think that’s an indication of the concern that we have about why it’s important to work collaboratively.”

“The Obama administration is not going to hesitate to speak out when we perceive that U.S. taxpayers or U.S. businesses are being treated unfairly,” he added.

According to a report by CNBC, Irish finance minister Michael Noonan said he disagreed “profoundly” with the EU’s ruling, and that Ireland would contest the decision.

In an open letter to customers posted on Apple’s website, Apple CEO Tim Cook said his company would also file an appeal. “We are confident that the Commission’s order will be reversed,” Cook wrote.