April 26, 2017 at 4:11 pm ET

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- E-mail to a friend

President Donald Trump’s administration on Wednesday released the core tenets of the White House tax agenda, sketching a general outline that leaves room for many more details, but already shows deviation from the House Republican blueprint.

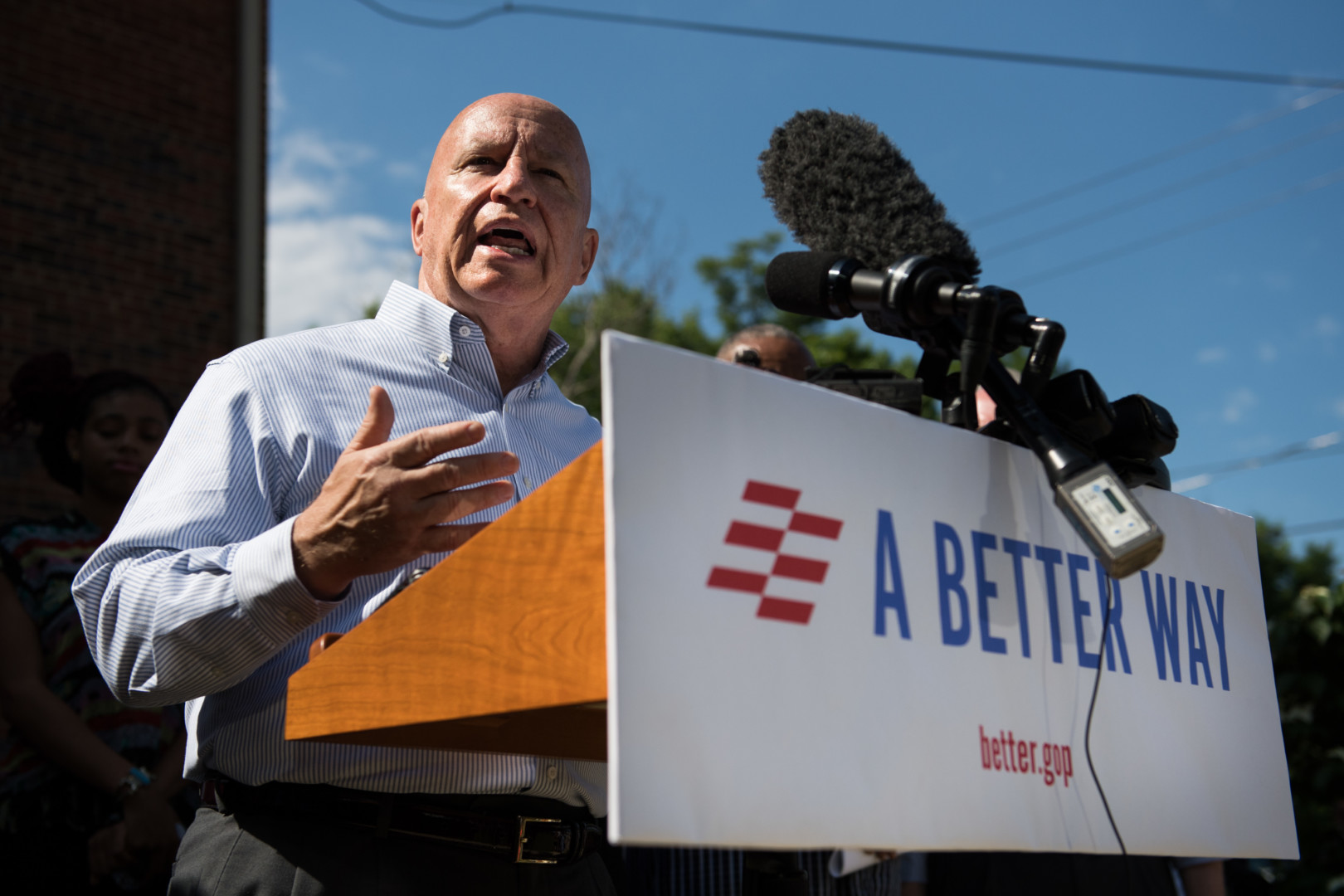

House and Senate GOP leaders and top tax writers applauded the principles. They “will serve as critical guideposts for Congress and the administration as we work together to overhaul the American tax system,” according to a joint statement Wednesday from House Speaker Paul Ryan (R-Wis.), Senate Majority Leader Mitch McConnell (R-Ky.), House Ways and Means Committee Chairman Kevin Brady (R-Texas) and Senate Finance Committee Chairman Orrin Hatch (R-Utah).

Gaps between proposed rates on businesses and individuals still separate the White House principles from the House GOP blueprint. Trump’s agenda, unveiled in a White House briefing Wednesday afternoon, would lower the corporate tax from 35 percent to 15 percent and apply that rate to “pass-through” businesses, too. The House GOP plan would tax corporations at 20 percent, and pass-throughs — businesses taxed through their owners’ individual returns — at 25 percent.

Trump’s plan whittles the seven current tax brackets down to three, at rates of 35, 25, and 10 percent, while the House GOP plan would tax individuals at 33, 25, and 12 percent rates. The current top individual tax rate is 39.6 percent. The plan would include a “territorial” tax system, but eschews the border adjustment proposal, a key revenue raiser at the heart of the House GOP plan. Treasury Secretary Steven Mnuchin said earlier Wednesday that the administration is discussing potential revisions to that measure.

“We are moving as quickly as we can” on moving legislation forward, Mnuchin said at the White House briefing Wednesday.

Trump’s plan would also eliminate all individual deductions except on mortgage interest and charitable donations, double the standard deduction, and scrap the estate tax and the individual alternative minimum tax.

The outline doesn’t include infrastructure spending, a legislative priority of Democrats that could have drawn them closer to the negotiating table. But the top Democrat on the Senate Finance Committee made it clear Wednesday that bipartisan tax reform isn’t out of the question.

“I’ve seen various statements that Democrats aren’t interested in tax reform,” Ron Wyden of Oregon told reporters Wednesday ahead of the White House briefing. “I’ve introduced comprehensive, bipartisan federal income tax bills with two Republican senators, now retired from the Senate, who have been very close to [Majority Leader] Mitch McConnell. So the idea that there’s no interest in bipartisan tax reform is not backed up by the facts.”

He expressed concerns about the impact of Trump’s tax proposal — billed by Mnuchin on Wednesday as “the biggest tax cut” in U.S. history — on the national debt. “Mr. Mnuchin has said that this is going to be the biggest tax cut in history. What I’m certainly interested in finding out is, is this going to be the biggest debt generator in history?”

Still, the lack of infrastructure spending in Trump’s principles — and Trump’s refusal to release his own tax returns — could impede bipartisan tax discussions.

Rep. Richard Neal of Massachusetts, top Democrat on the Ways and Means Committee, expressed disappointment Wednesday that the White House announcement didn’t address infrastructure.

And Rep. Lloyd Doggett (D-Texas) used the tax plan roll-out to needle the president over not releasing tax returns.

“Without an end to the Republican cover-up of Trump’s tax returns, we cannot determine whether this is mostly just more self-enrichment for the Trump family,” said Doggett, top Democrat on the Ways and Means tax policy subcommittee, in a statement Wednesday.

Other than infrastructure, potential compromise areas on the business side could range from repatriating cash from overseas or the House GOP full and immediate expensing proposal, according to former GOP tax writers. Those items are top priorities for Republican lawmakers aiming to erase what they see as disadvantages for U.S. businesses.

“Our broken code encouraged American companies to hold $2.5 trillion offshore,” Rep. Warren Davidson (R-Ohio), a member of the House Financial Services Committee and a strong critic of the estate tax, said in an email Wednesday. “Fixing our code with lower rates, full expensing, simplification, and repatriating those offshore dollars will help drive the growth that our families need in order to see wages rise, new jobs created, and new investment in our communities.”

“The estate tax is immoral and I look forward to voting to eliminate it,” he added.