May 25, 2017 at 3:11 pm ET

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- E-mail to a friend

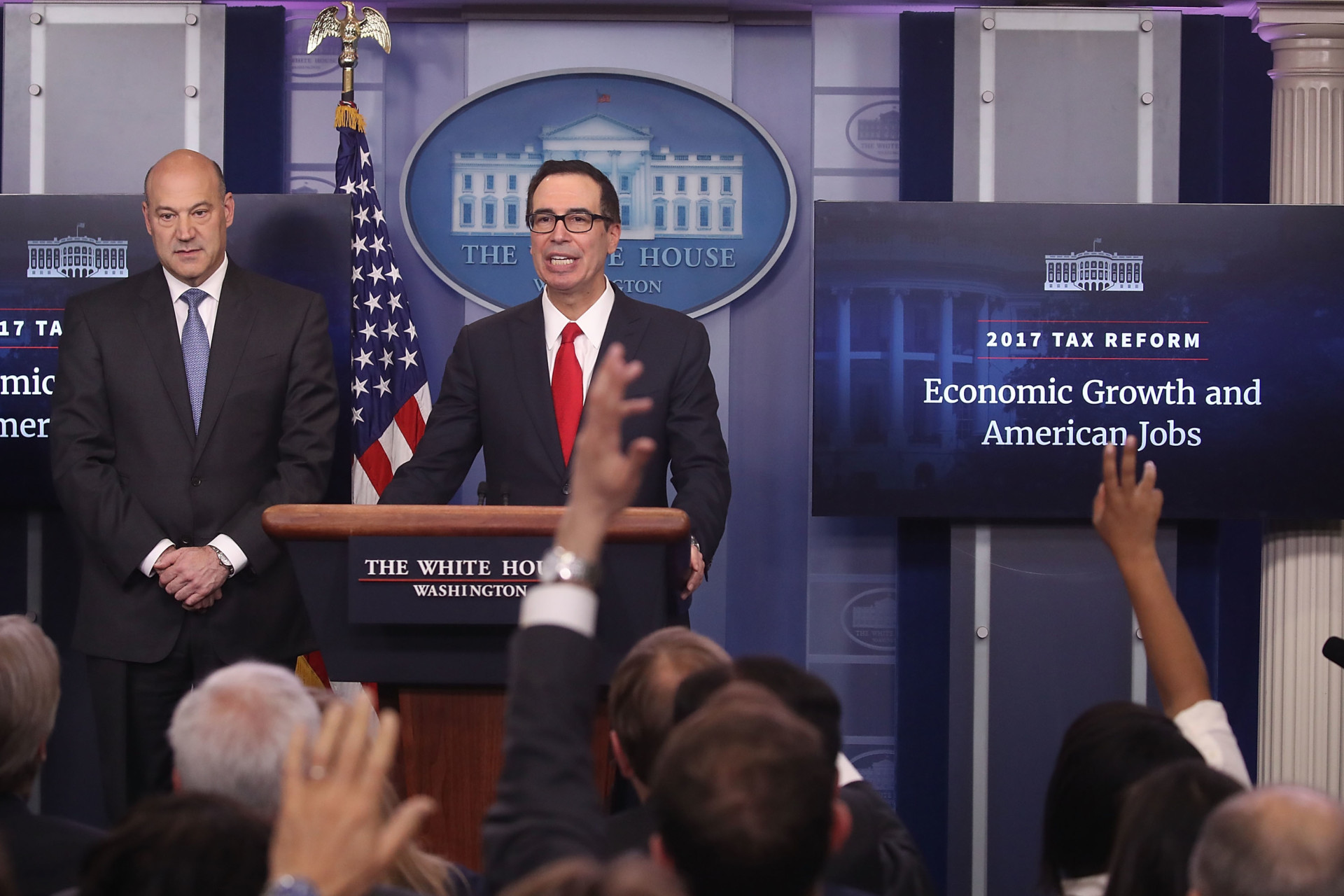

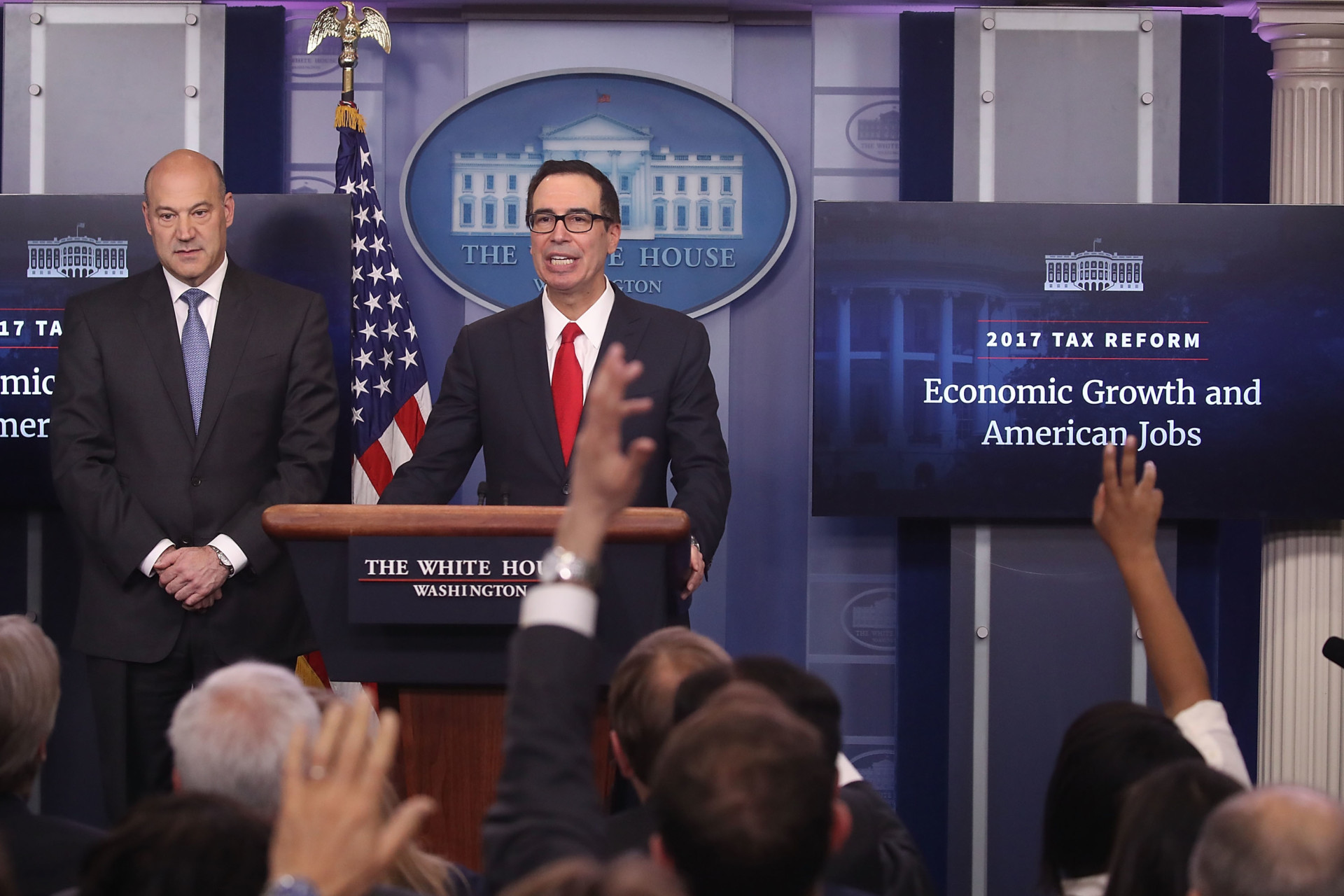

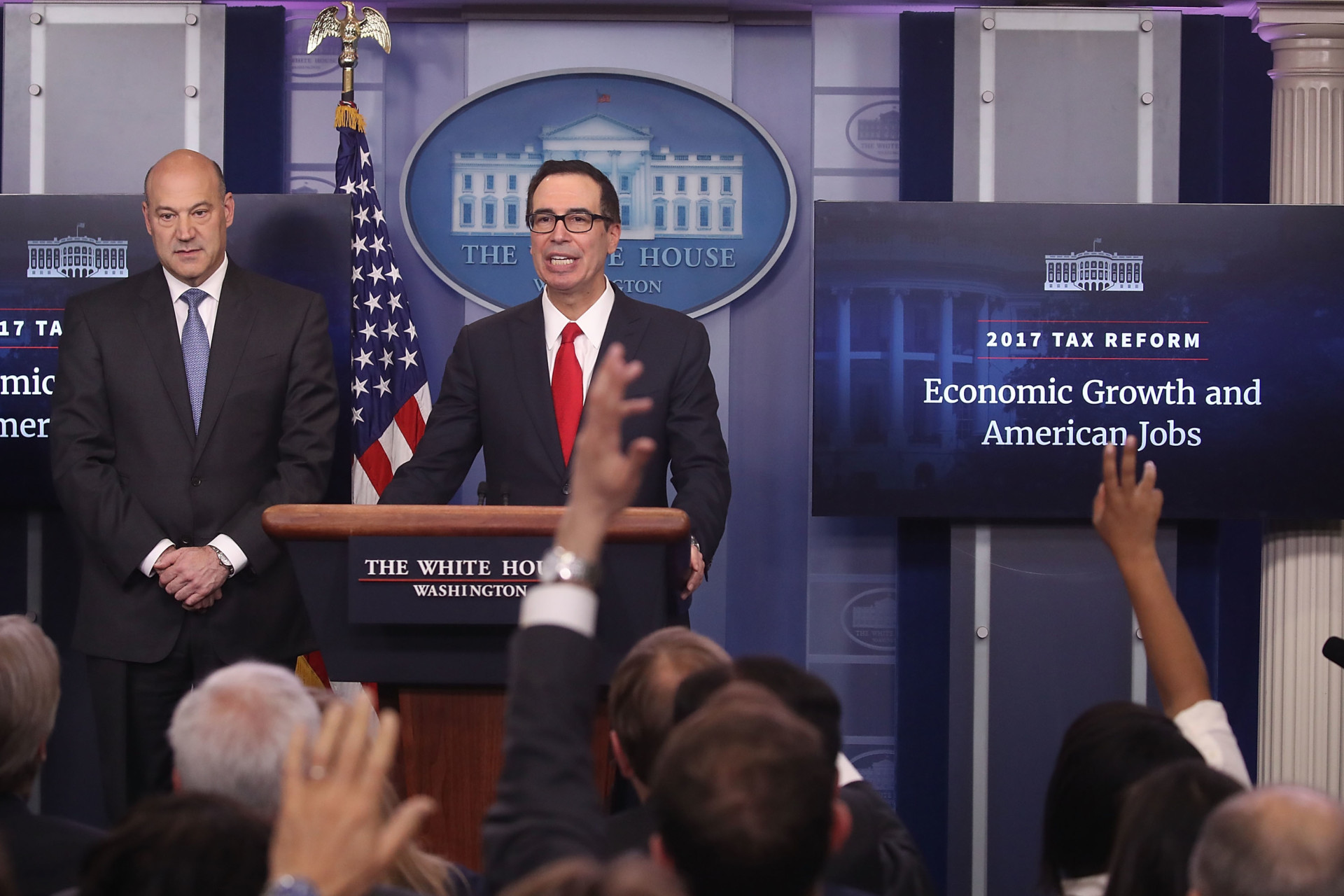

Two consecutive days of Capitol Hill testimony from Treasury Secretary Steven Mnuchin made it clear that White House policy still differs in key places from the House GOP tax overhaul plan.

Mnuchin, who testified Thursday before the Senate Finance Committee and Wednesday at the House Ways and Means Committee, has said several times that the White House does not support the border adjustment tax — a core component of the House GOP plan — in its current form.

“I have expressed — in its current form, I have concerns,” Mnuchin told lawmakers on the House tax-writing panel Wednesday.

The White House also has different ideas on how to treat businesses’ net interest deduction, which the House GOP plan would eliminate in favor of a full and immediate write-off of capital expenditures.

“I have heard some very strong concerns from small and medium-sized businesses that interest is an important part of what they need to be able to deduct,” Mnuchin said Thursday. “Our preference is to keep the interest deductibility, but that is one of the issues we’re looking at.”

House Ways and Means Chairman Kevin Brady (R-Texas) reiterated Thursday that lawmakers are working on revisions to border adjustment. Those changes could make it more palatable to administration officials.

“We’ve obviously entertained a lot of specific design changes to border adjustment to address areas, for example, in the services sector, so we’ll continue to explore those when we’re able to sit down and sort of work through that with the White House,” he told reporters.

A “generous transition” period for the policy could also ease some businesses’ concerns, Brady said. Some analysts warn that a slow phase-in could prompt currency and revenue issues, but it would ease businesses into the policy change gradually.

“A transition creates a number of benefits,” Brady noted. “It allows that currency to adjust and for businesses, and for us, to watch that unfold. Secondly, for companies who believe they can bring their supply chains back to America, a major goal of ours, it gives them plenty of time to be able to make that adjustment as well, especially if they have major investments overseas.”

For highly leveraged swaths of the economy, like agriculture, real estate and private equity, interest deduction is a crucial priority. Brady maintained that full and immediate expensing — in Brady’s view, “perhaps the most pro-growth [provision] of the Republican blueprint” — can spur intense growth.

Full expensing “drives productivity and Main Street jobs like, frankly, no other provision does,” Brady said. “We’re going to continue to make that case and work with the White House and the Senate on that.”

Mnuchin told senators Thursday that administration officials “are very focused on making sure that we have the appropriate policies on expensing capital goods to encourage people to invest.”

The border adjustment tax, which would tax imports and exempt exports, has mired the House GOP plan in a lobbying battle. Retailers say it would gouge shoppers at the cash register, while exporters argue it would give U.S. businesses a fair chance to compete internationally. It’s also a key revenue-raiser in the House plan.

Some House GOP tax writers, including Erik Paulsen (Minn.), Jim Renacci (Ohio) and Pat Tiberi (Ohio), expressed reservations this week about border adjustment, the subject of a Tuesday hearing.

Mnuchin said Wednesday that Treasury Department tax staffers are looking at other potential revenue-raising methods. “There’s lots of different scenarios we’re running,” he said.

The two key divergences could complicate tax negotiations between the White House, Senate and House GOP, particularly as Brady wants to build legislation based on a unified agenda.

“We’re focused on delivering this in 2017, and the best way to do that is to start with a unified plan,” he said Thursday.