Over Labor Day, the hard seltzer brand White Claw had its single biggest growth week of the year, according to Morning Consult Brand Intelligence, which tracks consumer perceptions of over 3,000 brands on a daily basis. By the end of the weekend, nearly one in five adults consumers said they were considering purchasing from White Claw, a seven point jump from the beginning of the week.

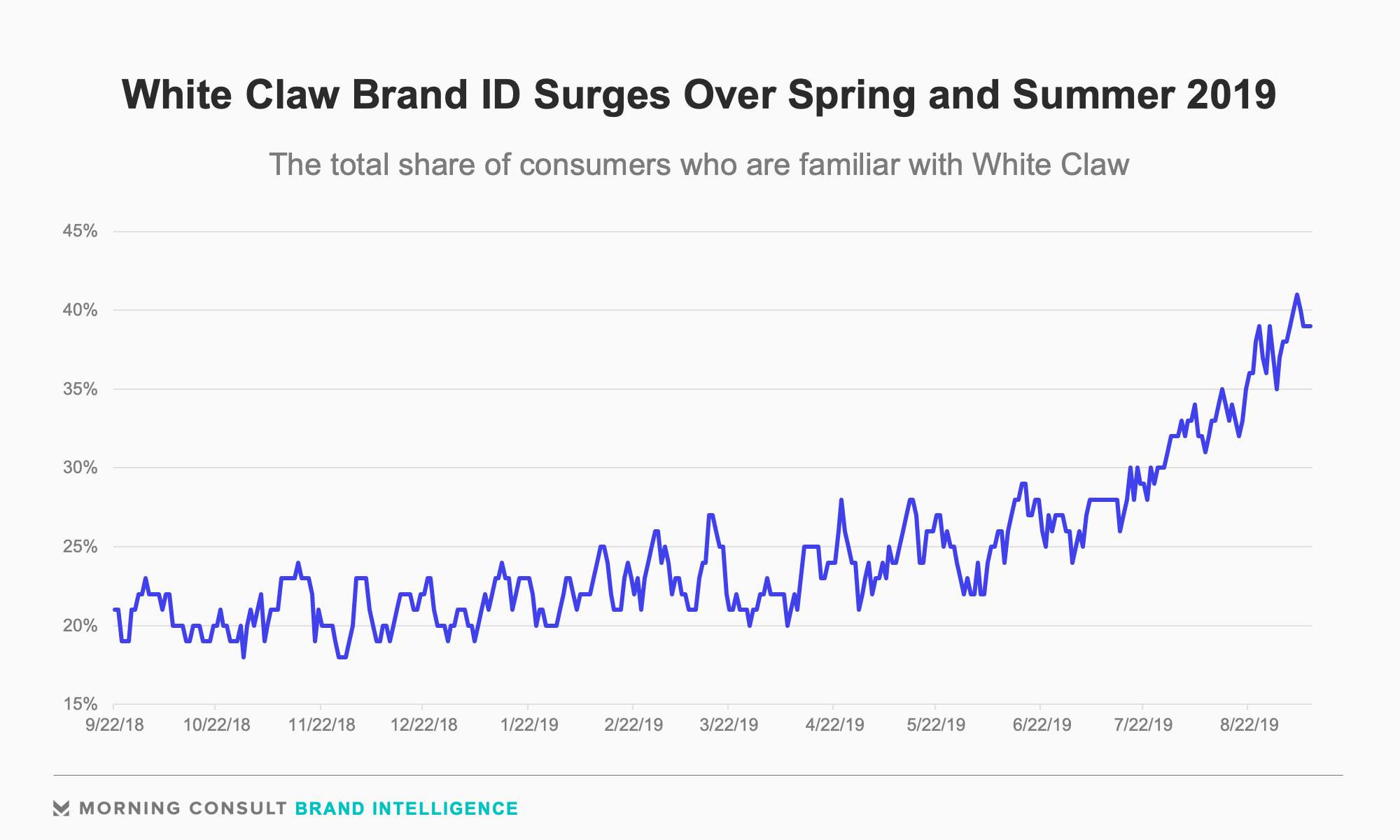

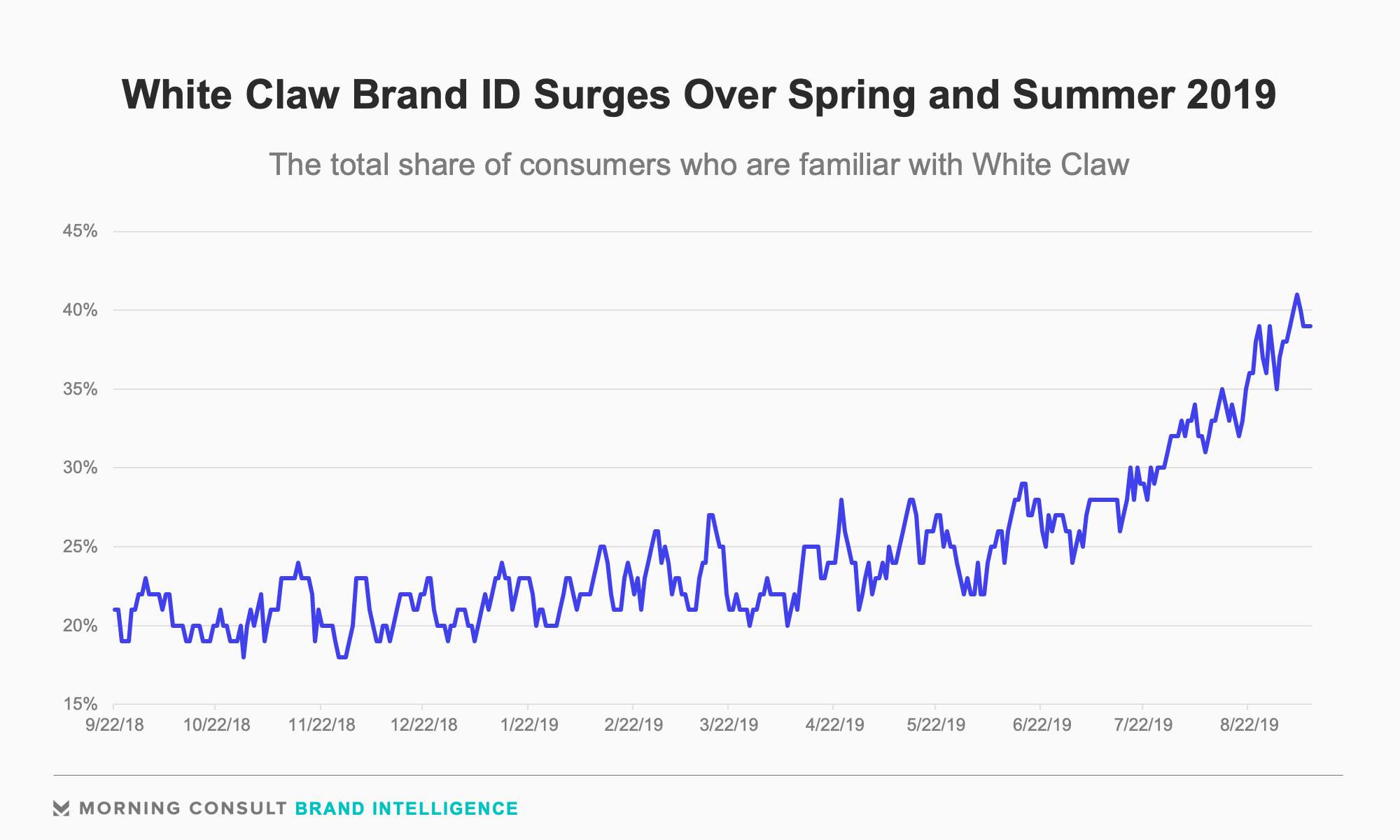

This surge capped off a remarkable spring and summer for White Claw’s brand, as well as the broader hard seltzer market. A relatively niche product last year, brands like White Claw and Truly are now beer aisle staples, with new competitors entering the market at a feverous pace.

Brand Intelligence data finds the share of consumers who are familiar with White Claw has doubled this year, with the bulk of the growth coming in just the last few months.

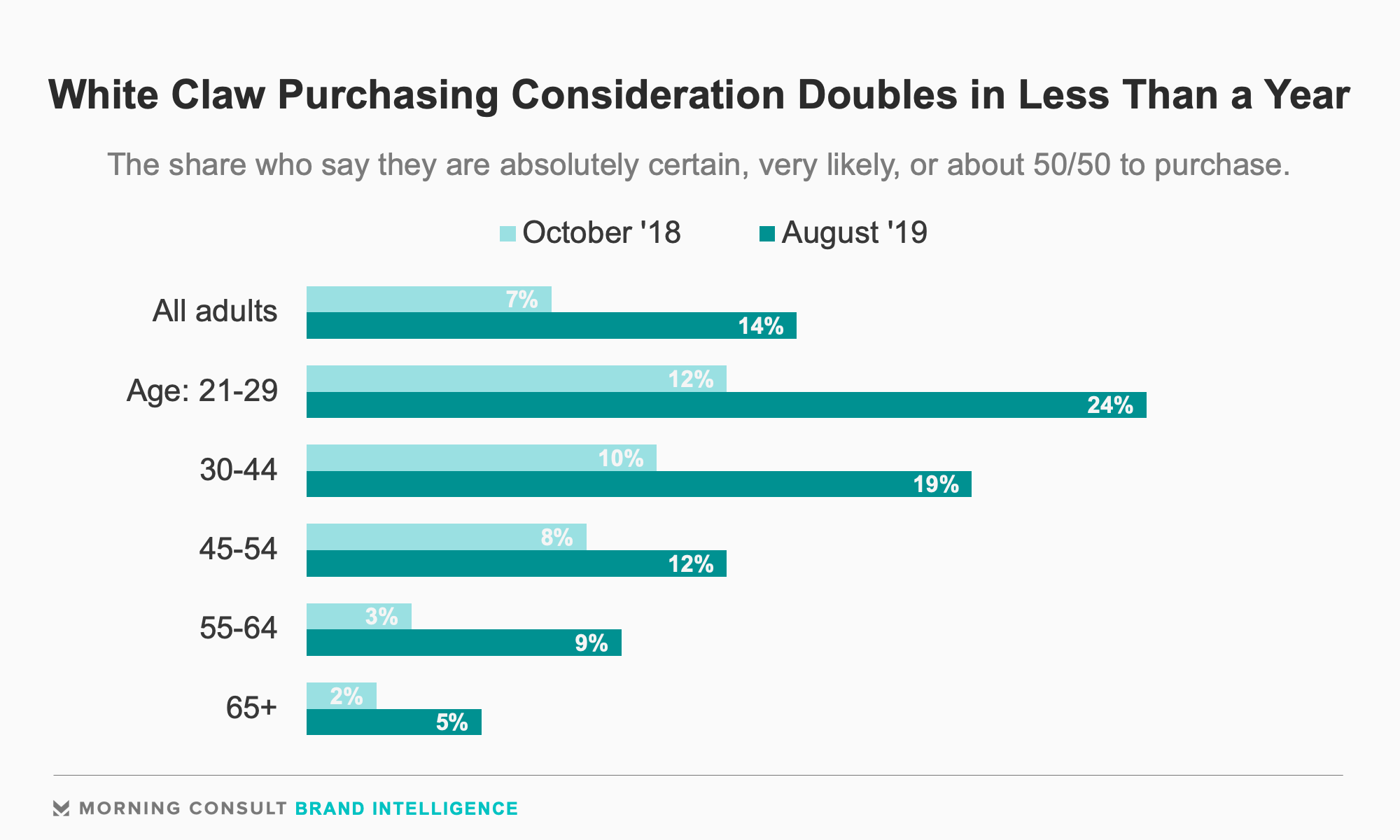

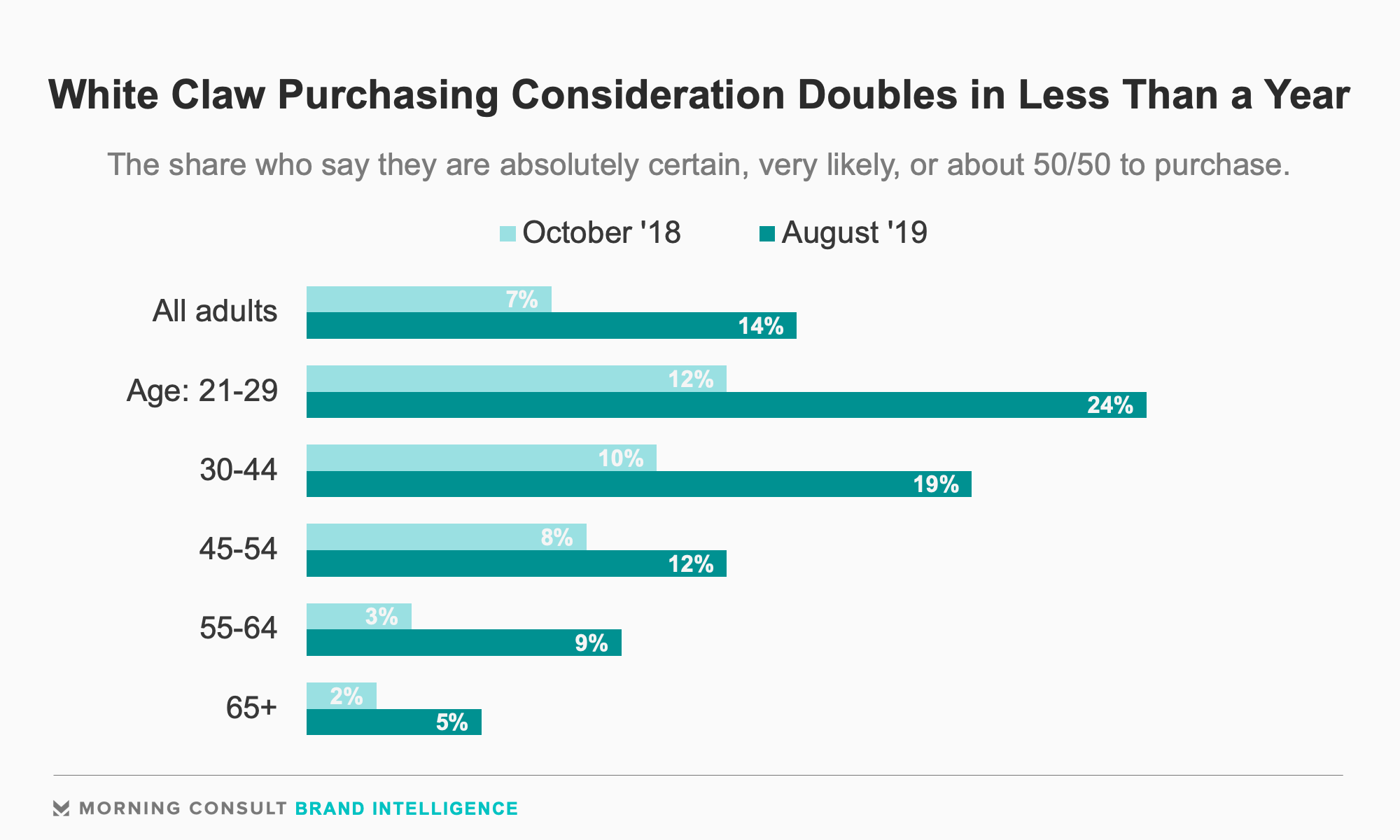

This growth in brand ID has been accompanied with a proportional rise in purchasing consideration. Among 21-29 year-olds, that growth has been particularly pronounced, jumping from 12 percent to 24 percent in less than a year.

For context, White Claw’s purchasing consideration levels are now equal to Sierra Nevada, the third largest craft brewer in the country.

Along with performing well with younger adults, White Claw also fares slightly better with urban and suburban Americans than rural ones. There is no difference in purchasing consideration between men and women – both sit at 14 percent.

Truly, which is also tracked in Brand Intelligence, has experienced relatively similar growth, although purchasing consideration lags slightly behind White Claw.

With over 75,000 annual interviews on every brand, Brand Intelligence brings together millions of survey interviews on thousands of brands to provide real-time insight and analytics into the most important brand metrics. The results on this page are based on 67,132 survey interviews with U.S. adults between September 15, 2018 and September 8, 2019.