Fast Casual Dining Growth: The Everyday Moments That Drive Brand Strength

Leaders from the world’s largest companies, equity research firms, hedge funds, and the Federal Reserve rely on Morning Consult’s 30,000 daily survey interviews in 45 countries covering more than 5,000 brands, economic indicators, and risk metrics. Schedule a demo to access the always-on consumer signal.

Category Advantage measures the drivers of brand strength by capturing both mental availability (likelihood a brand comes to mind) and emotional closeness (how strongly consumers connect with a brand) among all competitors. Schedule a private briefing on this research. .

The bottom line up front

Fast casual dining growth hinges on a handful of everyday moments—being top-of-mind when consumers are too tired to cook, want something affordable and filling, or need to grab dinner on the way home. The brands winning today aren't the most innovative; they're the ones showing up in more of these routine decisions. As value sensitivity rises, the opportunity is clear: own the moments that matter most, and you'll capture the growth.

The Category Landscape

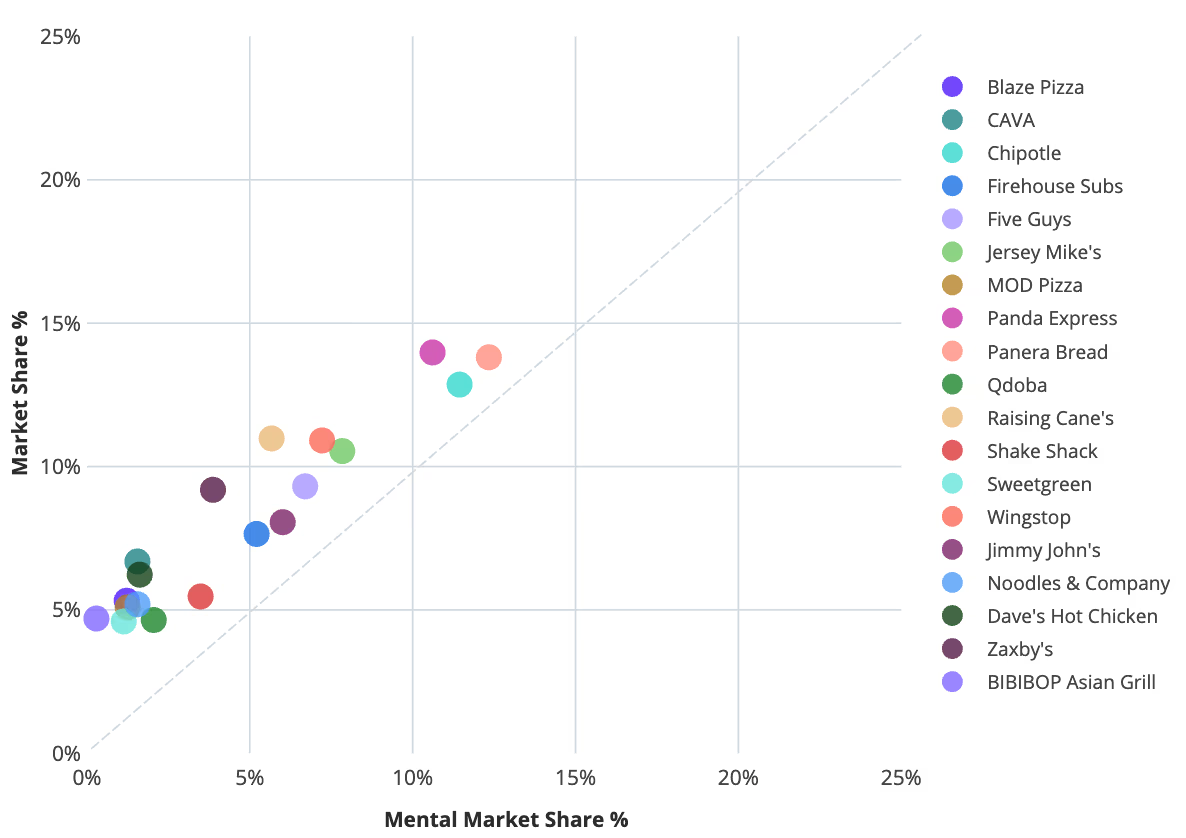

Three brands lead the pack on brand recall: Panera, Chipotle, and Panda Express lead on mindshare —when consumers think fast casual, these are the names that surface first. Panera leads slightly, with roughly three-quarters of category buyers holding it in active memory. Chipotle and Panda follow closely behind.

Breadth of associations separates leaders from followers: Sweetgreen, Chipotle, Panera, and Panda Express aren't just remembered—they're remembered across multiple situations (work lunches, dinner runs, road trips). This versatility is the real competitive advantage. Brands narrowly associated with one occasion are more vulnerable.

Opportunity signal: many brands are under-recalled relative to their actual presence. Raising Cane's, Zaxby's, and others have strong physical footprints but weaker brand recall. This gap suggests growth is available through awareness-building—not reinvention.

Where brands over- and under-perform across Category Entry Points

|

CAVA |

Chipotle |

Five Guys |

Panda Express |

Panera Bread |

Raising Cane's |

Sweetgreen |

|

|

Too tired to cook at home |

-11 |

-3 |

7 |

3 |

-8 |

7 |

-12 |

|

Affordable yet filling meal |

-7 |

1 |

1 |

6 |

-4 |

4 |

-10 |

|

Picking up dinner on the way home |

-10 |

-3 |

4 |

5 |

-9 |

7 |

-9 |

|

Quick, casual meal with coworkers or friends |

-4 |

0 |

5 |

0 |

2 |

2 |

-11 |

|

Road-trip food stop |

-9 |

-7 |

7 |

-4 |

-9 |

7 |

-12 |

|

Quick lunch on my work break |

-4 |

-3 |

3 |

2 |

-3 |

2 |

-9 |

|

Relaxed weekend brunch |

-3 |

-5 |

1 |

1 |

5 |

1 |

-7 |

|

Wanting something tasty that's also good for my health |

7 |

4 |

-5 |

-2 |

8 |

-7 |

5 |

|

Late-night bite when others are closed |

-8 |

-5 |

3 |

1 |

-9 |

6 |

-6 |

|

Healthier choice than typical fast food |

12 |

6 |

-8 |

-3 |

11 |

-8 |

17 |

|

Keeping energy levels stable |

-1 |

0 |

1 |

-2 |

-1 |

-1 |

-3 |

|

Smaller, protein-packed meal |

3 |

3 |

-1 |

-1 |

1 |

-1 |

1 |

|

Eating smaller portions |

3 |

-3 |

-2 |

2 |

5 |

-2 |

7 |

|

Meal tailored to my diet needs |

6 |

3 |

-3 |

-2 |

2 |

-3 |

9 |

|

Fiber-rich meal to feel full |

6 |

5 |

-2 |

1 |

3 |

-4 |

7 |

|

Post-gym refuel meal |

2 |

2 |

-1 |

-3 |

-2 |

-1 |

4 |

|

Make every bite count to avoid nutrient deficiencies |

4 |

1 |

-2 |

-1 |

0 |

0 |

5 |

|

Opting for fewer calories |

8 |

1 |

-6 |

-2 |

5 |

-6 |

17 |

|

Carb-conscious food to help me stay on track |

5 |

3 |

-2 |

-1 |

1 |

-3 |

9 |

Who Are Fast Casual Consumers?

.png?width=1920&height=219&name=f03aeead4c7046a1ac521d0fa6d56e18-screenshot-2026-02-08-at-4%20(1).png)

Economic sentiment: Fast casual consumers are more optimistic than the general population—but that confidence has been cooling over the past seven months. This rising value sensitivity makes clear pricing and portion reassurance more critical.

Media footprint: These consumers over-index heavily on Spotify, Reddit, Snapchat, LinkedIn, and Pinterest. Sports and news platforms (ESPN, NBA coverage, CNBC, NYT) are disproportionately effective reach channels.

Request a briefing on your category's users

The Moments That Matter

-

Fast casual isn't chosen for adventure—it's chosen for relief. The top triggers are predictable, high-frequency life moments:

-

"Too tired to cook at home" (~40%) — the single largest entry point. Dinner fatigue is the category's front door.

-

"Affordable yet filling meal" (~35%) — value isn't just price; it's the promise of satisfaction without overspending.

-

"Picking up dinner on the way home" (~33%) — commute convenience remains a cornerstone.

-

-

Secondary triggers include quick lunches on work breaks, casual meals with friends, and road-trip stops. Health-forward occasions exist but don't yet rival the "big three" above.

How Segments Differ

-

Income: As economic sentiment cools, the "affordable + filling" promise deserves protection. Menu architecture, bundling, and clear value signals become more important.

-

Age: Younger consumers (Gen Z/Millennial) are a "speed + digital habits" audience—channel first, not a fundamentally different category. Mobile-first touchpoints (Snapchat, Reddit, Spotify) and daypart triggers (work break, commute) matter most.

-

Gender/Region: Use for media and occasion weighting, not repositioning. The core moments remain stable; what shifts is frequency and channel efficiency.

Why This Matters Now

-

Value sensitivity is rising, but the opportunity isn't discounting—it's clarity. With consumer confidence cooling, brands that communicate predictable value (portion transparency, protein reassurance, frictionless ordering) will outperform those competing on price alone.

-

Health and value are converging. Interest in protein-forward, health-conscious options is growing—particularly among GLP-1 users and health-minded consumers. The brands that can reconcile "filling and affordable" with "better for me" will capture the next wave.

-

Breadth beats depth. Winning isn't about owning one moment—it's about showing up across many. The brands with the widest associative networks (remembered for dinner, lunch, road trips, and more) are best positioned for sustainable growth.

About this research

Morning Consult conducts over 30,000 daily proprietary surveys in 45 countries covering more than 5,000 brands and 50 economic indicators.

Our category advantage research is aimed at understanding the needs driving consumers in your category — and how your brand can own more of them. This research is built on validated principles of brand-driven growth and powered by Morning Consult’s industry-leading sampling technology.

Measure the true drivers of brand strength

Capture both mental availability (the likelihood your brand comes to mind when consumers face a need or occasion) and emotional closeness (how strongly consumers connect with your brand), benchmarked against competitors.

Uncover Category Entry Points (CEPs)

Directly tied to mental availability, see the specific needs, occasions, and triggers that drive purchase decisions in your category, and how strongly your brand is linked to them.

Pinpoint growth opportunities

Direct investment toward the moments and consumer segments with the greatest potential to grow your brand.

Turn insights into action fast

Get survey results in 4–5 days through a centralized dashboard and short-form memo that equips stakeholders with clear direction on where and how to win.

Learn more

Request a briefing for your industry

Morning Consult has pioneered a low-cost, AI-powered brand measurement solution that reveals the moments and needs driving consumers in your category — and how your brand can own more of them.

You May Also Like

These Related Stories

.png)

Panda Express’s Brand Strategy: Owning the Default Dinner Moment

.png)

Panera’s Category Advantage: Owning Health, Trust & Weeknight Growth

.png)