Why Michigan is Wrong, Consumer Sentiment Declined in January

Leaders from the world’s largest companies, equity research firms, hedge funds, and the Federal Reserve rely on Morning Consult’s 30,000 daily survey interviews in 45 countries covering more than 5,000 brands, economic indicators, and risk metrics. Schedule a demo to access the always-on consumer signal.

It’s time to say the quiet concern permeating corporate boardrooms and central banks out loud: the University of Michigan data wrongly represents the state of U.S. consumer sentiment.

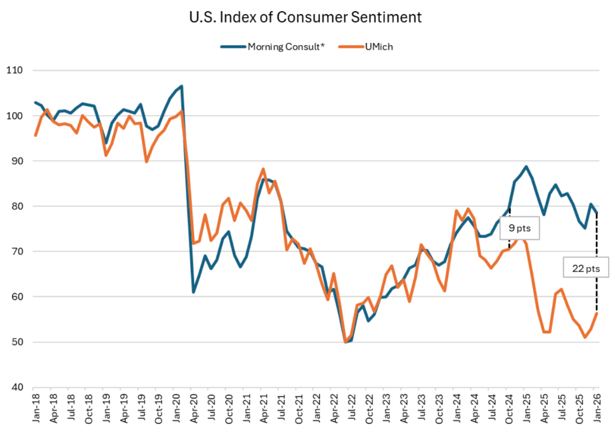

Executives, investors and policymakers who take the Michigan headlines at face value put themselves, their companies, and their constituents in grave peril. Case-in-point, the University of Michigan ICS released on January 23rd claims that US Consumer Sentiment reached a five-month high. From December 16 to January 19, Michigan conducted only 900 to 1,000 interviews and took an additional 4 days to report the data publicly.

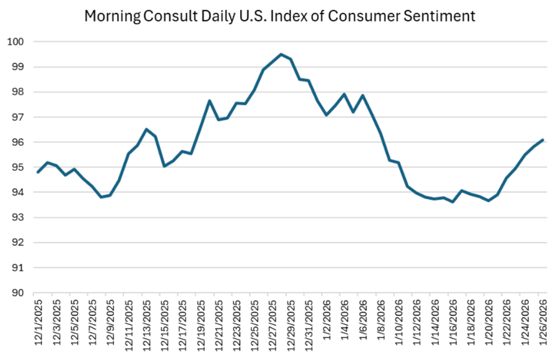

Over that time period in the U.S., Morning Consult conducted 140,594 survey interviews of the same questions shared daily with central banks. Our high-frequency, large-sample size consumer sentiment data clearly shows that consumer sentiment peaked the week of December 22nd and proceeded to decline rapidly for 3-consecutive weeks. Even the Conference Board, which also struggles with small sample sizes and lagged releases, recorded that consumer sentiment plummeted in January.

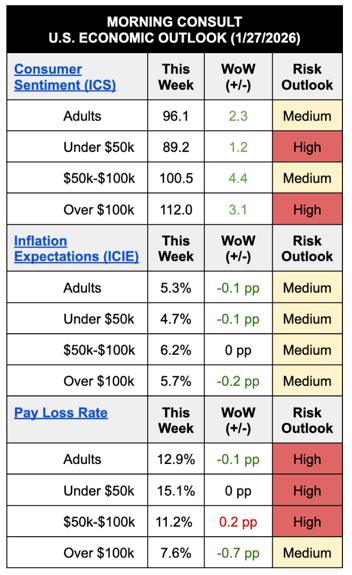

Morning Consult’s daily data shows that the Conference Board trend is unlikely to carry over into next month. The last full week of January was a good week for the U.S. economy and the consumer. The Morning Consult U.S. Index of Consumer Sentiment increased across the income spectrum, with Inflation Expectations falling and Pay Loss Rates trending lower. While this past week saw an improvement in consumer sentiment, the period from late December to mid January should not be quickly dismissed.

If you want to receive this weekly analysis, subscribe here or schedule time with Chief Economist John Leer.

How Michigan's methodological change created flawed data

Data from the University of Michigan has been wrong and misleading for the past 18 months due to changes in the survey’s methodology and sample composition, as found by leading economists from Yale and Stanford. In October 2024, the University of Michigan’s data was 9 points too low, and that gap ballooned to over 20 points following the election and ensuing trade war. Are changes in responses due to methodological inconsistencies or underlying economic realities? This very question is fundamentally concerning.

Relying on UMich data to inform corporate or investor decisions poses material risk for executives, especially for decisionmakers with fiduciary duties: the sample sizes are too small, the data is not collected every day, and the trend is misleading.

What we know from Morning Consult’s daily data is that consumers across the income spectrum are more vulnerable to pullbacks in labor demand. It would be wrong to conclude that the outlook for consumers has turned the corner and started to improve following the downshift in jobs growth in August and September 2025. To the contrary, companies should remain on high alert for additional signs of weakening demand.

*Normalized to UMich’s pre-online transition mean and standard deviation (Jan ‘18-Mar ‘24)

Request a briefing with our economists

Morning Consult’s Economic Intelligence delivers high-frequency data on consumer sentiment, spending, inflation, and labor markets.

You May Also Like

These Related Stories

UMich Transition to Online Surveys Breaks Time Series, Challenging Interpretation

.png)

Raising Cane’s Brand Strategy: Winning with Radical Simplicity in Fast Casual

.png)